What Is 15 Off Of 60

News Co

Apr 07, 2025 · 5 min read

Table of Contents

What is 15% Off of 60? A Comprehensive Guide to Percentage Calculations

Calculating discounts is a fundamental skill in everyday life, from shopping for groceries to understanding sales tax. This article delves deep into the seemingly simple question: "What is 15% off of 60?" We'll not only provide the answer but also equip you with the knowledge and methods to calculate percentages effectively in various scenarios. This will help you become more financially savvy and confident in your numerical abilities.

Understanding Percentages

Before we dive into the calculation, let's solidify our understanding of percentages. A percentage is simply a fraction expressed as a part of 100. The symbol "%" represents "per hundred." For example, 15% means 15 out of 100, or 15/100. This can also be expressed as a decimal (0.15) or a ratio (15:100).

This foundational understanding is crucial for grasping percentage calculations. Whether you're dealing with discounts, tax rates, interest rates, or any situation involving proportions, comprehending percentages is essential.

Method 1: Calculating 15% of 60

The most straightforward approach to finding 15% off of 60 involves two steps:

-

Find 15% of 60: To calculate 15% of 60, we multiply 60 by 0.15 (the decimal equivalent of 15%).

60 x 0.15 = 9

-

Subtract the result from the original amount: This step determines the final price after the discount.

60 - 9 = 51

Therefore, 15% off of 60 is 51.

This method is highly intuitive and easy to follow, making it ideal for quick mental calculations or situations where a calculator isn't readily available. It’s a fundamental approach that forms the basis for more complex percentage problems.

Method 2: Calculating the Remaining Percentage

An alternative approach involves calculating the remaining percentage after the discount. Since 15% is being discounted, 85% (100% - 15%) remains.

-

Calculate the remaining percentage: This is simply 100% - 15% = 85%.

-

Find 85% of 60: Multiply 60 by 0.85 (the decimal equivalent of 85%).

60 x 0.85 = 51

Again, the result is 51. This method is particularly useful when dealing with multiple discounts or when it's easier to calculate the remaining percentage.

Applying the Concepts: Real-World Examples

Let's illustrate these methods with practical scenarios:

-

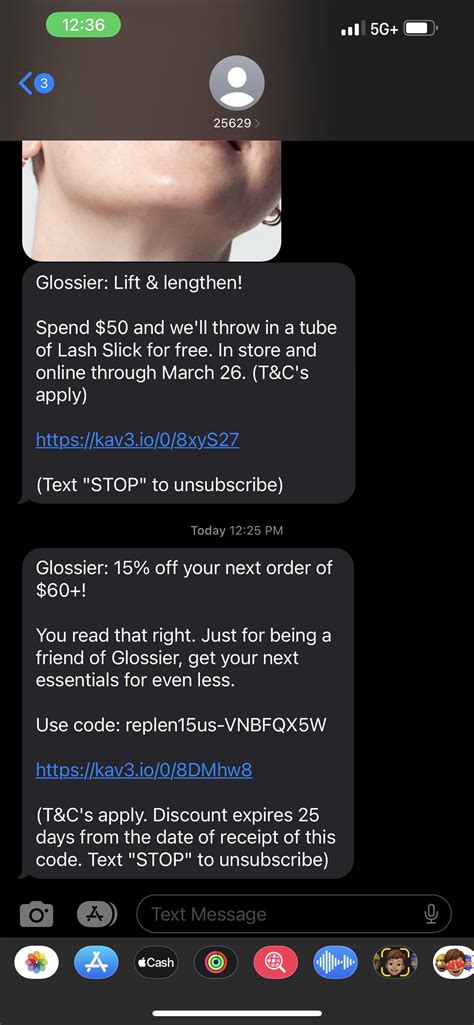

Scenario 1: Retail Sale: A shirt originally priced at $60 is on sale for 15% off. Using either method, the discounted price is $51.

-

Scenario 2: Restaurant Discount: A restaurant offers a 15% discount on the total bill. If your bill is $60, your final cost would be $51.

-

Scenario 3: Investment Returns: Imagine an investment of $60 yields a 15% return. The return would be $9, resulting in a total of $69. This shows how percentage calculations apply beyond discounts.

-

Scenario 4: Tax Calculation: If a sales tax is 15% and the price of an item is $60, the tax amount would be $9, making the total cost $69. This demonstrates that percentages aren't only used for discounts.

Expanding the Calculation: Handling Different Percentages and Amounts

The principles discussed above can be applied to any percentage and amount. Let's look at a few variations:

-

What is 20% off of 60? Following the same steps, 20% of 60 is 12 (60 x 0.20), and 60 - 12 = 48.

-

What is 15% off of 100? 15% of 100 is 15 (100 x 0.15), and 100 - 15 = 85.

-

What is X% off of Y? The general formula is: Y - (Y * X/100) = Discounted Price, where Y is the original price and X is the percentage discount.

These examples demonstrate the adaptability of these calculation methods.

Advanced Percentage Calculations: Dealing with Multiple Discounts and Taxes

Real-world scenarios often involve multiple discounts or taxes. Let's consider:

-

Scenario 5: Multiple Discounts: A store offers a 10% discount followed by a further 5% discount. This isn't simply a 15% discount. You apply the discounts sequentially.

- Calculate the first discount: 60 x 0.10 = 6; 60 - 6 = 54

- Calculate the second discount on the already discounted price: 54 x 0.05 = 2.7; 54 - 2.7 = 51.3

-

Scenario 6: Discount and Tax: An item is discounted by 15% and then subject to a 5% sales tax.

- Calculate the discount: 60 x 0.15 = 9; 60 - 9 = 51

- Calculate the tax on the discounted price: 51 x 0.05 = 2.55; 51 + 2.55 = 53.55

These scenarios highlight the importance of carefully applying the discounts and taxes in the correct order. Applying them simultaneously will result in an inaccurate final price.

Tips for Accurate Percentage Calculations

-

Use a calculator: For more complex calculations, a calculator significantly improves accuracy and efficiency.

-

Double-check your work: Always verify your calculations, especially when dealing with financial matters.

-

Understand the order of operations: Follow the correct order when dealing with multiple discounts or taxes to avoid errors.

-

Practice regularly: Consistent practice enhances your understanding and speed in percentage calculations.

-

Master the decimal equivalents: Quickly converting percentages to decimals is crucial for efficient calculations.

Conclusion

Calculating percentages is a practical skill with far-reaching applications. This in-depth guide has provided several methods for calculating discounts, highlighting their application in various real-world scenarios. By mastering these methods, you'll enhance your financial literacy and improve your ability to navigate everyday situations involving percentages. Remember, consistent practice and a clear understanding of the underlying principles are key to mastering percentage calculations. Now, go forth and conquer those percentage problems!

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is 15 Off Of 60 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.