How To Write 1800 On A Check

News Co

Mar 30, 2025 · 4 min read

Table of Contents

How to Write "1800" on a Check: A Comprehensive Guide

Writing a check might seem straightforward, but there are specific techniques to ensure your check is processed correctly and avoids potential issues. This comprehensive guide focuses on accurately writing "1800" on a check, covering various scenarios and offering best practices for preventing fraud and misunderstandings. We'll delve into the importance of precision, the different ways to represent the number, and tips to protect yourself from check fraud.

Understanding the Anatomy of a Check

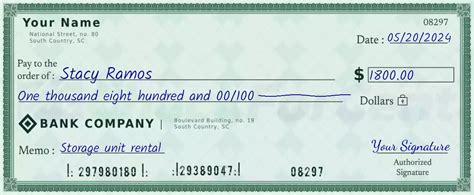

Before we jump into writing "1800" specifically, let's refresh our understanding of the key parts of a check. A standard check typically includes:

- Your Name and Address: This information is pre-printed at the top.

- Check Number: A unique identifier for each check, usually located in the upper right corner.

- Date: The date you're issuing the check.

- Pay to the Order of: This line specifies the recipient of the check. Write this clearly and completely. Any ambiguity can lead to processing delays or rejection.

- Numerical Amount: This is where you write the monetary amount numerically. This section is crucial for preventing fraud and ensuring accurate processing.

- Written Amount: This section is where you write the amount in words. This acts as a double check against errors and alterations.

- Memo or Note Section (Optional): You can add a brief description of the payment here.

- Your Signature: Your signature authorizes the payment.

Writing "1800" on a Check: The Correct Way

Now, let's address writing "1800" specifically. There are two crucial steps: writing the numerical amount and writing it out in words.

Writing the Numerical Amount

This is the straightforward part. Write "1800" in the numerical field, making sure it's clear and unambiguous. Avoid any ambiguity or alterations.

Important Considerations:

- Alignment: Align the numbers to the left, ensuring there's no space for someone to add digits before the number. This helps prevent fraud.

- Legibility: Use clear, distinct numerals. Avoid writing "1800" in a rushed or sloppy manner. This could lead to errors in processing.

- Zeroes: Do not omit zeros. A check made out to "180" instead of "1800" would cause significant issues.

Writing the Amount in Words

This is the crucial step in preventing fraud. Here’s how to write "1800" in words:

One thousand eight hundred dollars

Never abbreviate. Avoid writing "1800 dollars" or using symbols like "${content}quot;. Write it out completely.

Why is this important?

The written amount is legally binding and takes precedence if there's a discrepancy between the numerical and written amounts. This safeguard helps protect you from fraud in case someone tries to alter the numerical amount after writing the check.

Handling Potential Scenarios

Let's explore some scenarios that might require extra care when writing "1800" on a check.

Checks with Cents

While writing "1800" generally implies "1800 dollars," some situations might involve cents. For example, "1800.50" should be written as:

- Numerically: 1800.50

- In words: One thousand eight hundred and 50/100 dollars

International Checks

If you're issuing an international check, remember the currency. Clearly specify the currency, such as "One thousand eight hundred United States Dollars" or "Mille huit cents euros," depending on the country.

Writing Large Amounts

If you’re dealing with significantly larger amounts than 1800, the same principles apply. Be meticulous in your writing, and ensure both numeric and written amounts match precisely. Avoid any space or ambiguity for extra protection.

Prevention of Check Fraud

Check fraud is a significant concern. Here are some additional best practices to minimize your risk when writing a check for any amount, including 1800:

- Use a Check Register: Track your checks and their status carefully.

- Use Security Features: Many modern checks include security features like watermarks or specialized inks that are difficult to replicate.

- Never Leave Checks Blank: Never sign a check until you have filled out all the details.

- Consider Using Check Fraud Protection: Many banks offer services to protect you against check fraud.

- Report Suspicious Activity: If you suspect any check fraud, contact your bank immediately.

- Void Checks Carefully: If you need to void a check, write "VOID" across the check clearly and store it securely.

- Use a Pen: Avoid using pencil to write any information on the check. It's easily erasable, making it susceptible to alterations.

- Avoid Abbreviations: Avoid any abbreviation to prevent ambiguity, which could be a target for fraud.

Utilizing Technology

While handwriting remains common, some banking institutions offer online check writing features. These systems often have built-in safeguards that reduce the risk of errors and fraud. Explore whether your bank offers such services to further enhance your security.

Conclusion: Best Practices for Writing "1800" on a Check

Writing "1800" on a check, or any amount for that matter, demands precision and adherence to best practices. By accurately writing both the numerical and written amounts, aligning numbers properly, and following our tips to prevent check fraud, you ensure accurate processing and protect yourself from potential issues. Remember, a little extra care can go a long way in preventing headaches and ensuring smooth financial transactions. The careful and detailed approach outlined in this guide helps guarantee secure and efficient check writing. Always prioritize clarity, accuracy, and security when handling financial documents.

Latest Posts

Latest Posts

-

Greatest Common Factor Of 20 And 30

Apr 01, 2025

-

What Is 0 4 Repeating As A Fraction

Apr 01, 2025

-

First Derivative Test And Second Derivative Test

Apr 01, 2025

-

How To Find Equation Of A Vertical Line

Apr 01, 2025

-

Is 37 A Prime Number Or A Composite Number

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about How To Write 1800 On A Check . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.